As we all know, financial realities can change quickly. We are seeing that very sharply today and feeling it in our wallets. Last year gas prices were hovering around $3.00/gal. Today they have skyrocketed over $5.00/gal. That’s a 65% increase. Grocery prices are following close behind. Everything is going up (except our personal incomes and any investments)

The same economic forces are negatively impacting the financial outlook for operating the watershed – the price of logs is softening and starting to drop (-8.15% from one year ago – click here for timber price index chart as of May 16) while the costs to log and operate the watershed are rising with inflation.

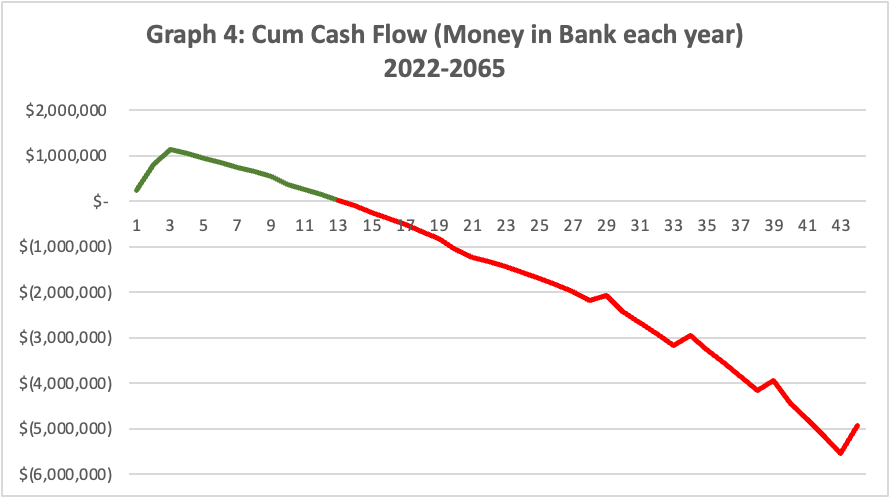

Last year’s operations plan showed a $291,000 loss before turning positive. Running the same model today using the new economic realities shows a loss of $1,500,000 – $5,000,000 and it never turns positive. This variation depends on whether the average rate of inflation is set unrealistically low 2% ($1,500,000 loss) or at the average 50 year annual rate of 3.84% ($5,000,000 loss).

The Board’s current financial plan was crafted in the best of times and it assumes that the good times will keep rolling on. Which is quickly no longer the case. The Board is not keeping the operations plan up to date and not looking at strategies for addressing the debt. Their answer is to get grants or have people donate more money. Rather than focusing on the financial viability of the watershed, the Board is promoting its recreational use. The situation for ratepayers is quickly moving from risky to precarious.

Running the Numbers (Or Jump directly to the charts below for the big picture)

In our work last year on the Finance Committee, Rick Gardner and I built a financial modeling tool and used that tool to develop the financial plan for operating the watershed. (A modeling tool is essential since Financial Planning is not a static event. It has to keep pace with the swings of our economy.) Using the modeling tool, we can easily change any number of financial variables to see the impact. Very quickly, we can adjust the financial plan to reflect changes in the economic situation.

Even though the Finance Committee has been inactivated by the Board as no longer necessary, we have continued independently to; a) work with members of the Arch Cape community who are in the timber business to assess the changing trends in log pricing and forestry costs, b) track the inflation rate (as have all of us) and c) monitor proposals from the Board’s consultants to record new line item expenses that are not in the current plan. We are putting all of that information into the financial model to keep the operations plan current.

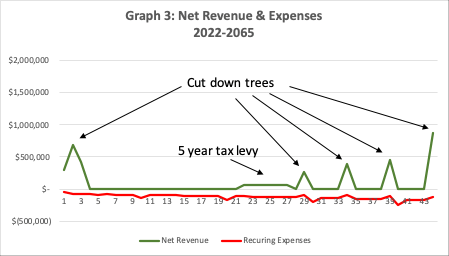

From running the financial model myriad times, it has become clear that the operations of this watershed is extremely sensitive to even the slightest swing in log pricing and the related logging costs. The reason is that the watershed is relatively small and does not have a large volume of trees that can be cut and sold (the advantage of scale does not exist with this watershed). Given the relatively limited number of trees, the price of every single tree that is cut down and sold is critical to overall financial viability of the watershed. If log prices are at an all-time high, as they were over the last couple of years, the best case scenario is a cumulative $291,000 debt over the next 30 years, even with a 5 year tax levy. HOWEVER, rather than remaining at an all-time high, logging prices are starting to drop and flatten and inflationary forces driving up costs. The ripple effect across the 43 year life cycle is significantly negative. (This is why the timber companies don’t want this piece of property.)

As for the other operations costs, we are no longer seeing all-time low inflation rates within the 2% range. Right now we are seeing an 8% range of inflation. The good news is that 8% inflation is unlikely to be the average rate over the next 43 years. The bad news is that we are unlikely to see a 2% average inflation rate again for a long while. We are more likely to see an average inflation rate closer to the past 50 year history of 3.84%

To make the Board’s plan even more untenable, the line item costs for operating the watershed are also going up. Last year’s costs were unverified estimates. And estimates are typically lower than the actual costs – especially since they are all over a year old. The Board has still not gotten confirmed pricing on high dollar costs such as road decommissioning and deferred maintenance. The Board has not changed the cost estimates for the $225,000 of timber stand improvement since they got them several years ago. Also, additional line-item costs are coming in from the Board’s consultants that were not budgeted and it now appears that our District Manager is responsible for overseeing the Board’s consultants and taking on the Property Manager role for at least a portion of his time (which is added cost for the watershed).

Bottom line: The Operating Plan goes negative in year 13 and runs to a $5,000,000 loss over the 43 year lifecycle of the watershed.

We have run several variations of the financial model and it’s a bit scary for ratepayers. With:

- Log sale prices slightly decreasing ONLY at an average of 4.6% across all the species in the watershed, staying flat for only 5 years and then increasing at 2% per year, and with

- Logging costs for cutting the trees increasing at 3% and costs for hauling them to the mills increasing at 8%, and then all costs increasing at 2% for 43 years (well below a likely average inflation rate), and with

- Operations costs increasing at an average rate of inflation of 3.84% over the next 43 years, and with …

- Newly identified line-item costs added, and even with …

- An additional $200,000 in donations and a 5 year tax levy

The financial plan starts losing money in year 13 and takes a deep dive to a loss of $5,000,000 over 43 years.

Even if we take an overly optimistic outlook and say that the average inflation rate stays at 2% for 43 years, the financial plan starts losing money in year 15 and takes a deep dive to a loss of $1,500,000 over 43 years.

Concern: The ratepayers & taxpayers will carry the financial burden

The Board doesn’t appear to understand the current operations plan much less how that plan no longer represents the likely financial reality. On their web site:

- They report that the money for operating the watershed for the next 10 years is “in hand”. (In actuality, they have understated the operations cost and the money is absolutely not in hand – see conversation “#5 – $833,000: Innocent Error or Intentionally Misleading”)

- They have posted a survey asking people how they think that watershed operations should be funded after 2033 (click here to see the question). (The relevance of this and the other questions are akin to rearranging the deck chairs on the Titanic. Given the revised financial plan, the only reasonable answer should be “all of the above / whatever we can get” – because the timber revenue alone won’t even come close.)

The Board is either not paying attention or they have no awareness or understanding of the impact of the new economic reality on the financial plan and, as a consequence, they have no strategy for addressing it.

The now projected loss of $5,000,000 cannot be realistically made up by tax levies, rate hikes and donations. It requires a fundamental relook of the plan and retooling to make it work. And this Board and their Sustainable Northwest consultant do not appear to have the skill set to do it.

It is essential that the Community is involved and has a say – as we will carry the financial burden of the operating loss.

A plan that looked like this last summer (2021) …

Now looks like this;

Detailed Assumptions

Click here for a detailed look at the financial assumptions used for the updated financial plan.

4 responses to “#9 – Can We Afford to Operate the Watershed: From Risky to Precarious”

Has the board received your revised financial costs/estimates, and if so what is its response?

LikeLike

They have received a copy and I will be presenting it in person at their Board Meeting on Thursday eve along with other public comments from members of the community interest group. I too am curious if/how they respond. I think this is a much higher priority than recreational use. No urgency on that topic. Bill

LikeLike

There are 3 things that are bothersome to me

1) there is a lot of money being spent to protect our source water when there doesn’t seem to be anything wrong with its quantity or quality to begin with.

2) it is financially irresponsible for the board to purchase property that we the ratepayers can’t afford to maintain, and we didn’t ask to buy it in the first place. $5,000,000 is a huge hole to fill

3) the “why’ behind all is seems pretty murky.

The Board repeatedly says that they are “buying this for the community”. Whenever I hear that statement I get mad. No one ever asked me, I don’t want it and now I have to pay for it!!!

LikeLike

I suspect you are not alone

LikeLike